COLUMBIA, Mo. – Farmers covered by federal crop insurance may not only have had their losses covered and avoided financial devastation during this year’s drought, but might have made more money than they had predicted in March, said a University of Missouri Extension economist.

“Insured farmers had a pretty good year,” said Ray Massey earlier this month at the MU Extension Agriculture and Natural Resources Annual Conference at the MU Bradford Research Center.

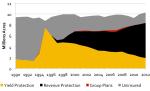

In 2012, approximately 70 percent of Missouri farm acres were revenue-protected by the Federal Crop Insurance Corporation (FCIC), Massey said. Another 13 percent had insurance based on yield protection.

“In a tough year like 2012, crop insurance is the difference between financial hardship and getting the crop into the ground next year,” said FCIC manager William J. Murphy.

Over a 10-year period in Missouri, $1.80 in federal crop insurance indemnities was paid out for every $1 paid in premium by farmers, said Ron Plain, MU Extension economist and professor of agricultural economics at MU’s College of Agriculture, Food and Natural Resources. “For the state of Missouri, it’s a good investment.”

Massey said most farmers did not take crop insurance until after 1990, when participation was a prerequisite to take part in other federal programs.

The federal government subsidizes crop insurance to give farmers an incentive to purchase it and to reinsure insurance companies that might have large losses from years like this one.

The USDA Risk Management Agency sets the costs, which vary by the level of coverage the farmer chooses. Because the cost is the same from agent to agent, Massey recommends that farmers choose an agent based upon their service.

Farmers who receive indemnities totaling more than $200,000 should expect to be audited by FCIC, he said.

For more information:

About the Federal Crop Insurance Corporation

FCIC, administered under the USDA Risk Management Agency, decreases production risk associated with adverse weather conditions, fire and pests in addition to price risks associated with fluctuating commodity markets.

Federal crop insurance is a public-private partnership that allows farmers to manage risk while shielding taxpayers from farm disaster bailouts by guaranteeing farmers a percentage of predicted crop revenue.

Read more http://extension.missouri.edu/news/DisplayStory.aspx?N=1592